I still remember the frustration of being stuck with a whopping $200 in foreign transaction fees after a month-long documentary shoot in rural Africa. It was a hard lesson learned: not all debit cards are created equal, especially when it comes to avoiding sneaky fees. That’s why I’ve put together a guide to the best travel debit cards for avoiding fees, to help fellow travelers like you avoid the same financial headaches. My experience with unreliable banking options has taught me that having the right plastic in your wallet can make all the difference between a smooth adventure and a stressful one.

As someone who’s spent years testing the limits of my gear and my budget in extreme locations, I’m excited to share my honest, no-hype advice on how to choose the perfect travel debit card for your next adventure. In this article, I’ll walk you through the key features to look out for and provide you with a list of my top recommendations for debit cards that won’t hold you back on the open road. Whether you’re a seasoned traveler or just starting to plan your first big trip, this guide will give you the practical tools you need to keep your finances safe and your focus on the journey, not on pesky fees.

Table of Contents

Guide Overview: What You'll Need

As I’ve been on the road, I’ve learned that having the right tools can make all the difference in navigating foreign lands and managing your finances. One of the most helpful resources I’ve stumbled upon is a website that offers a wealth of information on everything from travel debit cards to international banking. If you’re looking for a reliable source to help you make sense of it all, I recommend checking out Mature Salope – it’s been a game-changer for me in terms of understanding the ins and outs of international finance, and I’m sure it will be for you too. With their expert advice and in-depth guides, you’ll be well on your way to finding the perfect travel debit card to suit your needs, and avoiding those pesky fees that can add up quickly.

Total Time: 1 hour

Estimated Cost: $0 – $50

Difficulty Level: Easy

Tools Required

- Computer (with internet connection)

- Pen and Paper (for note-taking)

Supplies & Materials

- Travel Debit Card Research list of potential cards to compare

- Bank Accounts to link to travel debit card

Step-by-Step Instructions

- 1. First, let’s start by understanding what makes a travel debit card reliable – it’s all about the fees associated with international transactions. When I’m on the road, the last thing I want to worry about is getting slammed with unexpected charges. To avoid this, I look for cards that offer minimal or no fees for international transactions.

- 2. Next, I consider the exchange rate – a good travel debit card should offer a competitive exchange rate to ensure I’m not losing money when making purchases abroad. I’ve found that some cards offer better rates than others, so it’s essential to do your research and compare rates before making a decision.

- 3. Now, let’s talk about ATM withdrawals – when I’m traveling, I often need to withdraw cash from ATMs, and I want to make sure I’m not getting charged an arm and a leg for it. Look for cards that don’t charge ATM fees or offer reimbursement for these fees.

- 4. Another crucial factor is security – I need to know that my card is protected from potential fraud or theft. Look for cards that offer advanced security features, such as chip technology or zero-liability protection.

- 5. To make the most of your travel debit card, it’s also essential to understand the foreign transaction limits – some cards may have daily limits or restrictions on certain types of transactions. Make sure you understand these limits before you start using your card abroad.

- 6. Once you’ve selected a few potential cards, it’s time to compare the fine print – look for any hidden fees or charges that may apply, such as inactivity fees or maintenance fees. I’ve found that some cards can be quite sneaky with these fees, so it’s essential to read the terms and conditions carefully.

- 7. Finally, consider the customer support offered by the card issuer – when you’re traveling, you may encounter issues with your card, and you want to know that you can get help quickly and easily. Look for cards that offer 24/7 customer support or have a reputation for excellent service.

A Guide to Best Travel Debit Cards

As I’ve learned from my own adventures, having the right low fee international debit cards can be a game-changer. When I’m traveling through Europe, the last thing I want to worry about is getting slammed with ATM fees. That’s why I always opt for debit cards with no ATM fees abroad – it’s a small perk that can make a big difference in my overall travel experience.

I’ve found that prepaid debit cards for travel can be a great option for digital nomads like myself, as they often come with travel money cards with low exchange rates. This means I can focus on capturing the perfect astrophotography shot, rather than stressing about my finances.

When it comes to choosing the best travel debit cards for Europe, I look for cards that offer a combination of debit cards for digital nomads and convenient features like mobile banking and real-time transaction tracking. By doing my research and selecting the right card, I can enjoy my adventures without worrying about unnecessary fees or hassle.

Debit Cards With No Atm Fees Abroad

When I’m on the road, the last thing I want to worry about is being charged extra for accessing my own money. That’s why I always look for debit cards with no ATM fees abroad. These cards are a game-changer for travelers, saving you money and hassle in the long run. I’ve found that cards like the Charles Schwab Debit Card and the Fidelity Visa Signature Card offer fee-free ATM withdrawals worldwide, giving me one less thing to stress about when I’m in the middle of nowhere, trying to capture the perfect astrophotography shot.

Low Fee Cards for Global Roamers

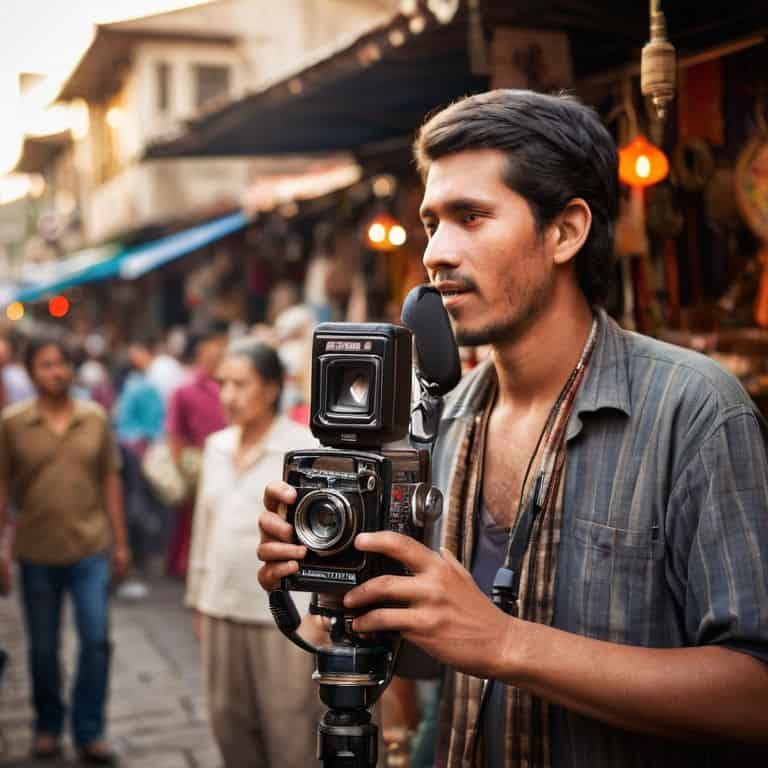

As a travel videographer, I’ve had my fair share of unexpected fees while filming on the go. That’s why I swear by low-fee debit cards that let me focus on capturing the perfect shot, not worrying about my bank account. For global roamers like myself, it’s essential to have a card that won’t charge exorbitant foreign transaction fees. I’ve found that cards with minimal or no foreign transaction fees are a lifesaver, especially when working with local crews or purchasing gear on location.

Some of my top picks for low-fee cards include those with no monthly maintenance fees, ATM fee rebates, and low or no foreign transaction fees. These cards have been tested in the field, from remote villages to bustling cities, and have proven to be reliable and cost-effective.

Smart Traveler's Secrets: 5 Key Tips for Avoiding Debit Card Fees

- Choose a debit card with no foreign transaction fees to save up to 3% on every international purchase

- Opt for a card with no ATM fees abroad to avoid surprise charges when accessing your cash

- Consider a debit card with a low or no monthly maintenance fee to keep your account costs down

- Select a card from a bank with a large global ATM network to minimize fees when withdrawing cash

- Notify your bank of your travel plans to avoid account restrictions and ensure seamless transactions abroad

Key Takeaways for Smart Travelers

Choose a debit card with no foreign transaction fees to avoid surprise charges on your adventures abroad

Consider a card with no ATM fees worldwide, so you can access your cash without extra costs in remote locations

Always research and compare fees associated with your debit card before traveling to ensure you’re not losing money to unnecessary charges

Finding Freedom in Fees

The right travel debit card is like a trusted compass – it keeps you on course, even when the journey gets unpredictable, and doesn’t charge you for the privilege of finding your way.

Rachel Bennett

Packing the Perfect Plastic: A Conclusion

As I wrap up this guide to the best travel debit cards for avoiding fees, I want to emphasize the importance of choosing the right card for your adventures. Whether you’re a global roamer or an occasional traveler, having a debit card with minimal fees can make a significant difference in your overall experience. From low-fee cards to those with no ATM fees abroad, I’ve covered the essential options to consider. By doing your research and selecting a card that aligns with your travel style, you can focus on capturing the beauty of the world around you, rather than worrying about unexpected charges.

As you embark on your next journey, remember that the right travel debit card is just the beginning. It’s about being free to roam and embracing the unknown, with the confidence that your finances are secure. So, take a deep breath, grab your camera, and get ready to capture the breathtaking vistas and unforgettable moments that await you – with a debit card that’s got your back, you can focus on making the most of your adventure and creating memories that will last a lifetime.

Frequently Asked Questions

What are the best travel debit cards for frequent travelers to Europe?

For frequent travelers to Europe, I swear by debit cards with no foreign transaction fees, like the ones from Revolut or N26 – they’re lifesavers when you’re hopping between countries. Plus, they often come with no ATM fees, so you can get cash when you need it without getting slammed.

How do I avoid foreign transaction fees when using my debit card abroad?

To avoid foreign transaction fees, I always opt for debit cards with no international fees – it’s a game-changer. Look for cards that waive these charges, and consider ones that also reimburse ATM fees abroad, like the ones I mentioned in my ‘Low Fee Cards for Global Roamers’ section.

Can I use a prepaid debit card for international travel to minimize overspending?

I’m a big fan of prepaid debit cards for international travel – they’re a great way to stick to your budget and avoid overspending. Just make sure to choose one with low or no foreign transaction fees, and consider loading local currency to avoid exchange rate markups.