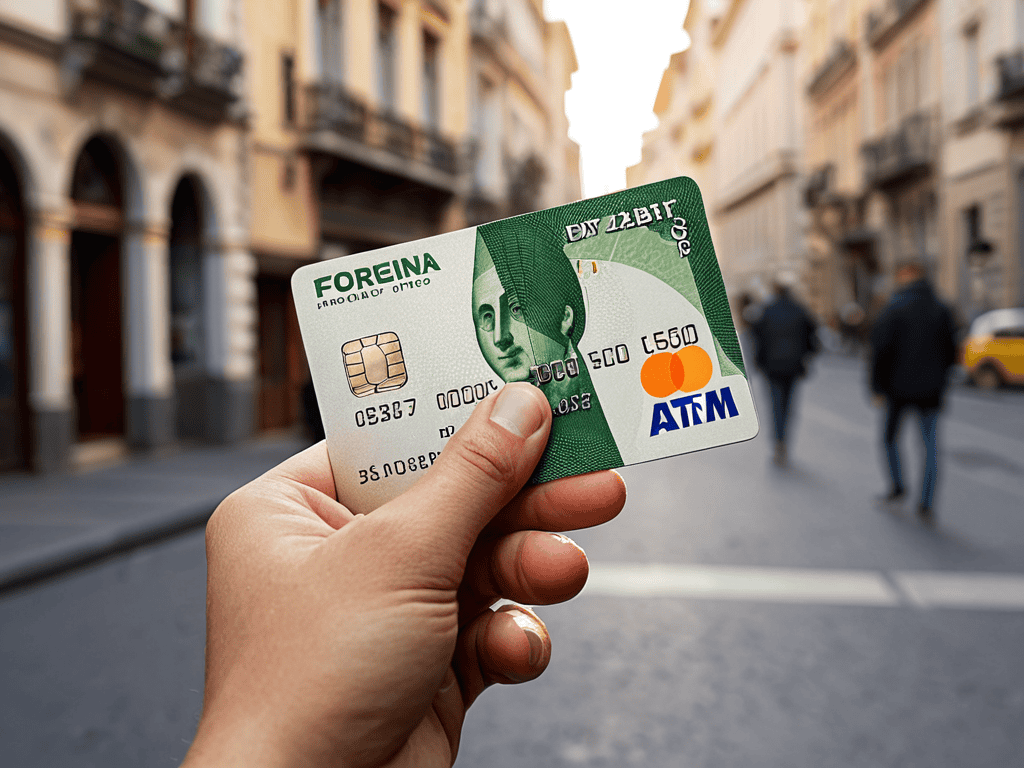

I still remember the frustration of being slapped with unexpected fees on my debit card while traveling through remote locations for my documentary projects. It’s a harsh reality that many of us face, and that’s why I’m passionate about creating a guide to the best travel debit cards for avoiding fees. The myth that all travel debit cards are created equal is simply not true, and it’s time to set the record straight. In my experience, the right debit card can make all the difference in enjoying a stress-free adventure.

As someone who’s spent years testing the limits of my gear in extreme environments, I’ve learned that practicality and reliability are key when it comes to choosing the right travel debit card. In this article, I’ll share my honest, no-hype advice on how to select a debit card that won’t hold you back on the open road. You can expect to learn about the top features to look for in a travel debit card, as well as some surprising pitfalls to avoid. By the end of this guide, you’ll be equipped with the knowledge to make an informed decision and start enjoying your adventures without the burden of unnecessary fees.

Table of Contents

Guide Overview: What You'll Need

Total Time: 1 hour 30 minutes

As I’ve been traveling and testing out different debit cards, I’ve come to realize that having the right resources can make all the difference in navigating foreign transactions. When I’m on the go, I need to be able to stay on top of my finances without getting bogged down in complicated fee structures. That’s why I’ve found it helpful to have a reliable guide to international banking and debit cards – it’s saved me from more than a few costly surprises. For instance, I recently stumbled upon a useful resource at erotikkontakte, which offered some valuable insights into managing my money while abroad. By being mindful of hidden fees and taking the time to research my options, I’ve been able to minimize unnecessary expenses and focus on what really matters: capturing the beauty of the world around me through my lens.

Estimated Cost: $0 – $100

Difficulty Level: Easy

Tools Required

- Computer (with internet access)

- Pen and Paper (for note-taking)

Supplies & Materials

- Travel Debit Card Research Materials List of potential cards and their fees

- Calculator (for calculating potential savings)

Step-by-Step Instructions

- 1. First, research the fees associated with your current debit card to understand what you’re up against – this will be your baseline for comparison. Look for any foreign transaction fees, ATM fees, and monthly maintenance fees that might be sneaking up on you.

- 2. Next, make a list of your travel plans for the next year, including destinations and the length of your trips. This will help you determine which features are must-haves for your new debit card, such as no foreign transaction fees or high ATM withdrawal limits.

- 3. Now, compare debit cards from different banks and financial institutions, looking for ones that specifically cater to travelers. Check for cards with low or no fees, convenient ATM networks, and robust customer support.

- 4. Consider the exchange rate offered by each debit card, as some may offer more favorable rates than others. You’ll also want to look into any partnerships the card issuer has with international banks or ATM networks, which can help reduce fees.

- 5. Apply for the card that best fits your travel needs, making sure to read and understand the terms and conditions. Be wary of any hidden fees or minimum balance requirements that might catch you off guard.

- 6. Once you’ve received your new debit card, test it out before your trip by making a small purchase or withdrawing cash from an ATM. This will help you ensure that everything is working smoothly and that you’re not going to encounter any unexpected issues while abroad.

- 7. Finally, keep track of your expenses while traveling, using a budgeting app or spreadsheet to monitor your spending and stay on top of any transaction fees or interest charges. This will help you make the most of your debit card and avoid any costly surprises when you get back home.

A Guide to Best Travel Debit Cards

When it comes to navigating low fee international debit cards, it’s essential to consider more than just the fees themselves. I’ve found that debit cards with no ATM fees abroad can be a game-changer for travelers, especially when combined with a solid understanding of exchange rates. By doing your research and choosing a card that aligns with your travel style, you can save yourself a significant amount of money in the long run.

In my experience, travel money cards with low exchange rates are often overlooked in favor of more traditional debit cards. However, these cards can offer a unique combination of flexibility and cost savings, making them an attractive option for travelers who need to manage their finances on the go. By taking the time to compare different international debit card comparison tools, you can find the card that best fits your needs and avoid unnecessary fees.

As someone who’s spent countless hours researching and testing different debit cards, I can confidently say that fee free debit cards for international travel are worth the investment. By opting for a card with minimal fees and low exchange rates, you can focus on enjoying your trip rather than worrying about unexpected charges. Whether you’re a seasoned traveler or just starting to plan your next adventure, taking the time to find the right debit card can make all the difference.

Debit Cards With No Atm Fees Abroad

When I’m on the road, the last thing I want to worry about is getting charged extra fees for accessing my own money. That’s why I swear by debit cards with no ATM fees abroad. These cards are total game-changers for travelers, saving you money and hassle in the long run. I’ve had my fair share of experiences with surprise fees, and let me tell you, it’s not fun.

I’ve found that cards like the Charles Schwab Debit Card and the Fidelity Visa Gold Checking debit card offer no foreign transaction fees and reimburse you for any ATM fees you incur. It’s a huge relief to know that I can withdraw cash whenever I need it, without worrying about extra charges.

Low Fee International Debit Cards

When it comes to international travel, debit card fees can add up quickly. That’s why I’m always on the lookout for low-fee options that won’t break the bank. I’ve found that some of the best international debit cards offer minimal to no foreign transaction fees, making them a game-changer for travelers.

I’ve had great experiences with cards that charge minimal or no fees for international ATM withdrawals and transactions. These cards have been a lifesaver on my adventures, from withdrawing cash in rural Africa to paying for meals in Japan.

Nailing the Basics: 5 Essential Tips for Picking the Best Travel Debit Card

- Choose a debit card with no foreign transaction fees to save money on international purchases

- Consider a card with a low or no ATM fee for withdrawals abroad to minimize extra charges

- Opt for a debit card from a bank with a large global ATM network to reduce the likelihood of hefty fees

- Select a card with real-time transaction alerts to help you stay on top of your spending and avoid potential scams

- Prioritize a debit card with robust fraud protection and zero-liability policies to protect your finances in case something goes wrong

Key Takeaways for Adventurers

I’ve found that the right travel debit card can be a game-changer for minimizing fees and maximizing your adventure fund, with some cards offering zero foreign transaction fees and no ATM fees abroad

When choosing a travel debit card, consider the card’s network, ATM fees, and foreign transaction fees to ensure you’re not getting nickel and dimed on your travels

By selecting a debit card with low or no fees, you can keep more of your hard-earned cash for the things that matter most on your trip, like capturing breathtaking astrophotography shots or trying local cuisine

The Freedom to Roam

A good travel debit card is like a trusted compass – it helps you navigate unfamiliar terrain without losing your way, or in this case, your money.

Rachel Bennett

Embracing Fee-Free Adventures

As I wrap up this guide to the best travel debit cards for avoiding fees, I want to emphasize the importance of choosing the right card for your adventures. We’ve explored low-fee international debit cards and debit cards with no ATM fees abroad, all of which can make a significant difference in your travel budget. By opting for a card that minimizes fees, you can allocate more resources to experiencing the beauty of foreign lands, trying new foods, and immersing yourself in different cultures. Remember, it’s all about finding the perfect balance between practicality and freedom to enjoy your travels without financial stress.

As you embark on your next journey, I hope you’ll consider the impact that a well-chosen debit card can have on your adventure. With the right card by your side, you’ll be free to focus on the things that truly matter – capturing breathtaking landscapes, connecting with fellow travelers, and creating unforgettable memories. So go ahead, take the leap, and discover a world of possibilities with a debit card that won’t hold you back.

Frequently Asked Questions

What are the best travel debit cards for frequent international travelers?

As a travel videographer, I’ve tried countless debit cards, but my top picks for frequent international travelers are those with no foreign transaction fees and minimal ATM charges, like the Schwab Bank High Yield Investor Checking Debit Card or the Capital One 360 Checking Debit Card.

How do I avoid foreign transaction fees when using my debit card abroad?

To avoid foreign transaction fees, I swear by debit cards with no international fees – they’re a game-changer. Look for cards that explicitly state they don’t charge foreign transaction fees, and always check the fine print before you leave.

Can I use a prepaid debit card to avoid overspending while traveling?

Prepaid debit cards can be a great way to stick to your budget while traveling. I’ve used them myself to avoid overspending in remote locations where tracking expenses can be tricky. Just be aware of any foreign transaction fees or reload charges that might apply – it’s essential to choose a card with low or no fees to get the most out of your travels.